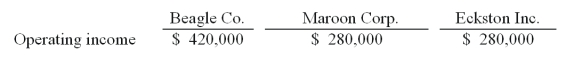

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Operating income totals for 2011 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 unrealized gain on intra-entity transfers to Maroon.

-The accrual-based income of Maroon Corp. is calculated to be

Definitions:

Annually

Relating to something that happens once a year.

Variable Costs

Costs that vary directly with the level of production or sales volume; they rise as production increases and fall as production decreases.

Fixed Costs

Expenses that do not change with the level of production or sales activities within a certain scale.

Net Working Capital

A liquidity calculation that represents the difference between a business's current assets less its current liabilities, highlighting operational efficiency and short-term financial health.

Q13: If Watkins issued common stock valued at

Q23: Bill can cook dinner in 45 minutes

Q24: Blanton Corporation is comprised of five operating

Q29: What is meant by the term hedging?

Q49: An intercompany sale took place whereby the

Q51: Dog Corporation acquires all of Cat,Inc.for $400,000

Q67: What adjustment is needed for Webb's investment

Q73: Which of the following is a normative

Q78: What accounting method requires a subsidiary to

Q104: Compute the amortization of gain for 2009