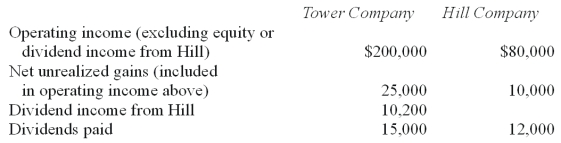

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-What is the tax liability for the current year if consolidated tax returns are prepared?

Definitions:

Radical Politics

Political philosophies or movements that advocate for fundamental and transformative changes to society, often opposed to the established social order and mainstream ideologies.

College Students

College students are individuals enrolled in a college or university program leading to an academic degree or certificate.

Mainstream Society

The dominant or prevailing cultural norms, beliefs, values, and practices in a given society, often contrasted with those of subcultures or minority groups.

Griswold v. Connecticut

A landmark U.S. Supreme Court case in 1965 that established the right to privacy regarding marital contraception, paving the way for future rights to privacy.

Q4: Compute Collins' share of Smeder's net income

Q10: What amount should have been reported for

Q26: What is the total noncontrolling interest in

Q34: Compute the amount of Hurley's equipment that

Q45: Under the equity method of accounting for

Q46: How much of this expense should be

Q54: One kind of gain from specialization is

Q79: What information does SFAS 131 require to

Q82: How will dividends be reported on consolidated

Q146: Productivity efficiency in saving lives<br>A) is not