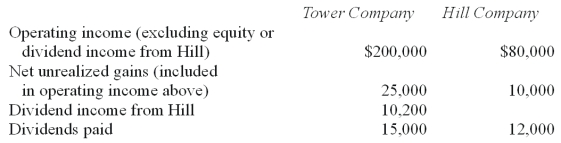

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-Using percentage allocation method, how much income tax expense is assigned to Hill?

Definitions:

Syntax

The set of rules, principles, and processes that govern the structure of sentences in a given language, especially the arrangement of words and phrases.

Sound

Vibrations that travel through the air or another medium and can be heard when they reach a person's or animal's ear.

Syntax

The arrangement of words and phrases to create well-formed sentences in a language.

Linguistic Relativity

The hypothesis that the structure of a language affects its speakers' world view or cognition, and thus people's perceptions are relative to their spoken language.

Q26: An intercompany sale took place whereby the

Q30: The hardware operating segment of Bloom Corporation

Q35: Assuming that Musial owned only 90% of

Q37: Combined segment revenues are calculated to be<br>A)$29,400.<br>B)$25,200.<br>C)$26,600.<br>D)$28,000.<br>E)$27,300.

Q41: No society can provide its citizens with

Q45: For what amount should Sales be credited

Q59: If push-down accounting is used,what amounts in

Q67: Woolsey Corporation,a U.S.company,expects to order goods from

Q67: Which of the following statements is true

Q69: Alpha,Inc. ,a U.S.company,had a receivable from a