REFERENCE: Ref.07_17 On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s Outstanding Common

REFERENCE: Ref.07_17

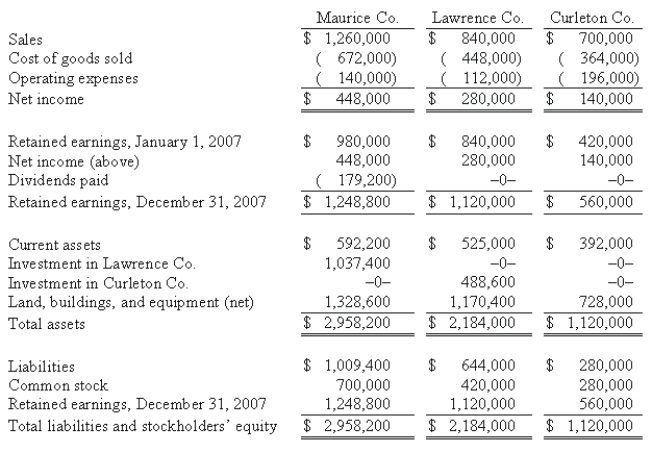

On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s outstanding common stock.On the same date,Lawrence acquired an 80% interest in Curleton Co.Both of these investments were accounted using the initial value method.No dividends were distributed by either Lawrence or Curleton during 2009 or 2010.Maurice paid cash dividends each year equal to 40% of operating income.Reported operating income totals for 2009 were as follows:  Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

I can't edit picture.Need to change the three years in the schedules - each from 2007 to 2010  The years should be 2010 instead of 2007 in this table

The years should be 2010 instead of 2007 in this table

-Required:

Determine the noncontrolling interest in Lawrence Co.'s net income.

Definitions:

More Information

An expression used to request or signify the need for additional data or details.

Securities Act Of 1933

A U.S. law enacted as part of the New Deal, aimed at regulating the offer and sale of securities to protect against fraud.

Investment Price

The amount of money paid to purchase an investment, such as stocks, bonds, or real estate.

Well-Known Seasoned Investor

An individual or entity recognized by securities laws as having sufficient experience and financial sophistication to participate in certain types of investment opportunities.

Q5: Determine the amount and account to be

Q11: If Goehler applies the equity method in

Q15: What is the dollar amount of non-controlling

Q28: What is the non-controlling interest's share of

Q41: Compute cost of goods sold and gross

Q76: What consolidation entry would have been recorded

Q85: What is the primary accounting difference between

Q93: Due to a scarcity of resources,<br>A) governments

Q108: Where do dividends paid by a subsidiary

Q120: Because economists have different values,like everyone else,they<br>A)