REFERENCE: Ref.06_03

These questions are based on the following information and should be viewed as independent situations.

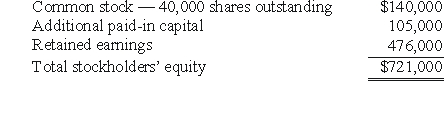

Popper Co.purchased 80% of the common stock of Cocker Co.on January 1,2004,when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

On January 1,2009,Cocker reported a net book value of $1,113,000 before the following transactions were conducted.Popper uses the equity method to account for its investment in Cocker,thereby reflecting the change in book value of Cocker.

-On January 1,2009,Cocker issued 10,000 additional shares of common stock for $35 per share.Popper acquired 8,000 of these shares.How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Same Workgroup

refers to a team of individuals who are assigned to the same task or project within an organization and who work closely together to achieve common goals.

Transactional Leadership Behaviour

A leadership style focused on supervising, organizing, and performance; leading through clear structures and reward and punishment.

Contingent Reward Behaviour

A leadership approach where rewards or recognition are given to subordinates based on their performance or achievement of specific goals.

Laissez-faire Leadership

A leadership style characterized by minimal managerial intervention. Leaders provide tools and resources, but employees have the freedom to solve problems and make decisions on their own.

Q9: How much foreign exchange gain or loss

Q16: Kordel Inc.holds 75% of the outstanding common

Q38: Compute consolidated land at date of acquisition.<br>A)$2,060.<br>B)$1,800.<br>C)$260.<br>D)$2,050.<br>E)$2,070.

Q39: On January 1,2010,Chester Inc.acquires 100% of Festus

Q49: Microeconomic models focus on the behavior of<br>A)

Q51: What is consolidated noncurrent assets as of

Q61: Pear,Inc.owns 80 percent of Apple Corporation.During the

Q84: Goehring,Inc.owns 70 percent of Harry,Inc.The consolidated income

Q117: On January 1,2009,Jumper Co.acquired all of the

Q133: Normative economics deals with<br>A) how the economy