REFERENCE: Ref.06_03

These questions are based on the following information and should be viewed as independent situations.

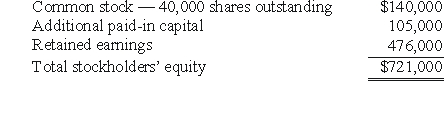

Popper Co.purchased 80% of the common stock of Cocker Co.on January 1,2004,when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

On January 1,2009,Cocker reported a net book value of $1,113,000 before the following transactions were conducted.Popper uses the equity method to account for its investment in Cocker,thereby reflecting the change in book value of Cocker.

-On January 1,2009,Cocker issued 10,000 additional shares of common stock for $21 per share.Popper did not acquire any of this newly issued stock.How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Accounting Profit

The net income for a company, calculated by subtracting total expenses from total revenues.

Depreciation

The approach in accounting where the expense of a tangible or physical asset is spread across its lifespan.

Payroll Expense

The total amount of money a company pays to its employees as salaries and wages, including taxes and other deductions.

Depreciation Expense

The distribution of a physical asset's cost across its lifespan, mirroring its depreciation over time.

Q9: Fraker,Inc.owns 90 percent of Richards,Inc.and bought $200,000

Q18: What amount should be included as a

Q36: The noncontrolling interest in the net income

Q37: Prepare Panton's journal entry to recognize the

Q43: Assume that Polar sold inventory to Icecap

Q66: What is the total amount of revenues

Q76: How is the gain on an intercompany

Q96: Compute consolidated retained earnings as a result

Q110: If Watkins pays $450,000 in cash for

Q113: Which of the following is true concerning