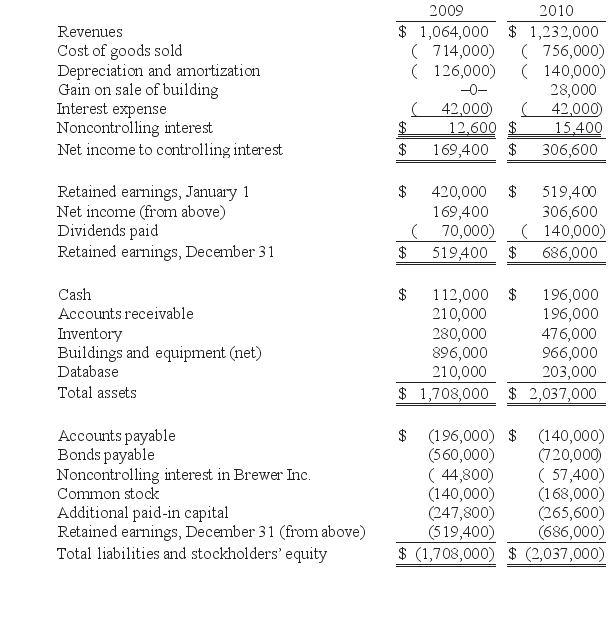

Allen Co.held 80% of the common stock of Brewer Inc.and 40% of this subsidiary's convertible bonds.The following consolidated financial statements were for 2009 and 2010.

Additional Information:

Bonds were issued during 2010 by the parent for cash.

Amortization of a database acquired in the original combination amounted to $7,000 per year.

A building with a cost of $84,000 but a $42,000 book value was sold by the

parent for cash on May 11,2010.

Equipment was purchased by the subsidiary on July 23,2010,using cash.

Late in November 2010,the parent issued common stock for cash.

During 2010,the subsidiary paid dividends of $14,000.

Required:

Prepare a consolidated statement of cash flows for this business combination for the year ending December 31,2010.Either the direct method or the indirect method may be used.

Definitions:

Q1: When a subsidiary is acquired sometime after

Q7: On January 1,2009,Bast Co.had a net book

Q22: Which of the following characteristics is not

Q52: Which of the following is usually not

Q54: What are consolidated sales and cost of

Q59: What are the three goals of probate

Q61: According to the revenues test,which segment(s)are separately

Q109: Dalton Corp.owned 70% of the outstanding common

Q120: Assume the initial value method is used.In

Q155: Suppose a new freshman enters State U