REFERENCE: Ref.05_02 On January 1,2009,Pride,Inc.bought 80% of the Outstanding Voting Common Stock

REFERENCE: Ref.05_02

On January 1,2009,Pride,Inc.bought 80% of the outstanding voting common stock of Strong Corp.for $364,000.Of this payment,$28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000.Any remaining excess was attributable to goodwill which has not been impaired.

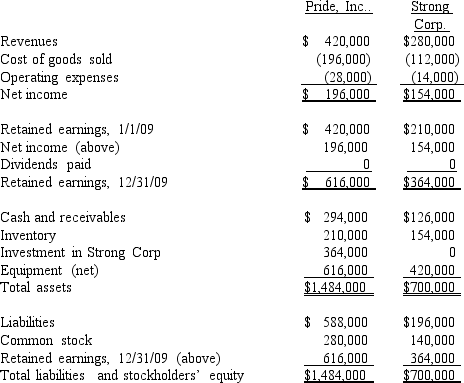

As of December 31,2009,before preparing the consolidated worksheet,the financial statements appeared as follows:

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

-What is the consolidated total for equipment (net) at December 31,2009?

Definitions:

Genes

Units of heredity made up of DNA that determine specific traits by encoding proteins.

Endocrine Glands

Glands of the endocrine system that secrete hormones directly into the bloodstream to regulate body processes.

Hormones

Chemical messengers produced by the endocrine glands that regulate various bodily functions by acting on specific target organs.

Bloodstream

The flowing body fluid that circulates through the heart, arteries, capillaries, and veins, carrying nutrients and oxygen to and waste materials away from all body tissues.

Q6: Compute income from Stark reported on Parker's

Q14: What is the adjusted book value of

Q15: A demonstrative legacy is a<br>A)gift of personal

Q20: What is consolidated net income for 2009?

Q38: Which one of the following accounts would

Q59: Pigskin Co. ,a U.S.corporation,sold inventory on credit

Q67: Woolsey Corporation,a U.S.company,expects to order goods from

Q77: Keenan Company has had bonds payable of

Q99: The Rivers Co.had four separate operating segments:

Q128: Opportunity costs arise in production because<br>A) resources