REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90% owned subsidiary of Simon Company,bought equipment from Simon for $68,250.On January 1,2009,Simon realized that the useful life of the equipment was longer than originally anticipated,at ten remaining years.The equipment had an original cost to Simon of $80,000 and a book value of $50,000 with a 10-year remaining life as of January 1,2009.

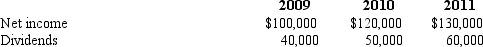

The following data are available pertaining to Wilson's income and dividends:

-Compute the gain on transfer of equipment reported by Simon for 2009.

Definitions:

Tax Rate

A percentage at which an individual or corporation is taxed.

Executive

A high-ranking person in a company or other institution, typically responsible for making large corporate decisions.

Finance Department

A division within an organization responsible for managing financial actions including budgeting and investment strategies.

CFO

Chief Financial Officer, a senior executive responsible for managing the financial actions of a company.

Q9: What amount of goodwill should be attributed

Q12: X-Beams Inc.owned 70% of the voting common

Q19: Assuming that separate income tax returns are

Q24: Compute the amount allocated to trademarks recognized

Q31: When a parent uses the initial value

Q72: Which statement is true regarding a foreign

Q88: A U.S.company buys merchandise from a foreign

Q98: Compute the amount of Hurley's buildings that

Q107: Hoyt Corporation agreed to the following terms

Q113: Prepare any 2010 consolidation worksheet entries that