REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90% owned subsidiary of Simon Company,bought equipment from Simon for $68,250.On January 1,2009,Simon realized that the useful life of the equipment was longer than originally anticipated,at ten remaining years.The equipment had an original cost to Simon of $80,000 and a book value of $50,000 with a 10-year remaining life as of January 1,2009.

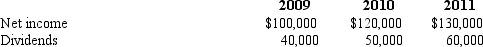

The following data are available pertaining to Wilson's income and dividends:

-Compute the amortization of gain for 2009 for consolidation purposes.

Definitions:

Brutal Owners

Individuals who exercise harsh and cruel control over others, particularly in contexts like slavery or abusive employment practices.

Slave Church

A religious gathering or place of worship created or used by enslaved African Americans, especially during the period of American slavery.

Large Plantations

Extensive agricultural estates typically found in tropical or subtropical regions, where crops like cotton, sugar, and tobacco are cultivated, often with the use of forced or cheap labor.

Primary Transmitter

A device or entity responsible for sending the initial signal or message in a communication system or network.

Q5: Determine the amount and account to be

Q9: The estate of Bobbi Jones has the

Q36: Prepare the consolidation entries that should be

Q41: If the parent's net income reflected use

Q45: A parent company owns a 70 percent

Q52: What financial statements would normally be prepared

Q52: Assuming Baker makes the change in the

Q56: Which of the following statements is true?<br>A)Delta

Q85: Compute Parker's reported gain or loss relating

Q118: If Goehler applies the initial value method