REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90% owned subsidiary of Simon Company,bought equipment from Simon for $68,250.On January 1,2009,Simon realized that the useful life of the equipment was longer than originally anticipated,at ten remaining years.The equipment had an original cost to Simon of $80,000 and a book value of $50,000 with a 10-year remaining life as of January 1,2009.

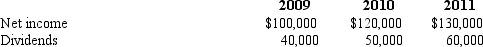

The following data are available pertaining to Wilson's income and dividends:

-Compute Simon's share of income from Wilson for consolidation for 2011.

Definitions:

Economic

Relating to the production, distribution, and consumption of goods and services, as well as the management of money and resources.

Lewin's Change Model

A framework developed by Kurt Lewin which describes organizational change through three stages: Unfreezing, Changing, and Refreezing.

Resisting Forces

Forces or factors that obstruct or slow down the process of organizational change, often arising from individuals' fear of the unknown or loss of control.

Strategic Redefine

The process of reassessing an organization's strategy to adapt to changes in the internal or external environment.

Q32: What criteria must be met before a

Q49: If Smith's net income is $100,000 in

Q55: How should contingencies be reported in an

Q76: When consolidating a subsidiary under the equity

Q90: Compute income from Stark reported on Parker's

Q95: Which of the following statements is false

Q96: When consolidating a subsidiary under the equity

Q97: Where do intercompany sales of inventory appear

Q105: Compute the amount of Hurley's equipment that

Q110: If Watkins pays $450,000 in cash for