REFERENCE: Ref.03_06

Kaye Company acquired 100% of Fiore Company on January 1,2009.Kaye paid $1,000 excess consideration over book value which is being amortized at $20 per year.Fiore reported net income of $400 in 2009 and paid dividends of $100.

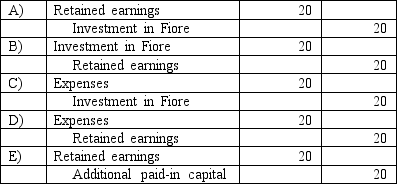

-Assume the partial equity method is used.In the years following acquisition,what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

I am not able to accept changes below.The balloons won't go away!

Definitions:

Economies of Scale

The economic benefits that businesses gain from their size of operations, where the expense per unit of production typically lowers as the scale increases.

Increasing Returns

A situation in which an increase in the scale of production results in a disproportionate increase in output, usually leading to lower average costs.

Suffer Losses

occurs when a business or individual incurs expenses that exceed their revenues.

Long-run

A period of time in economics during which all factors of production and costs are variable, allowing for full industry adjustment.

Q14: What is the adjusted book value of

Q18: Edgar Co.acquired 60% of Kindall Co.on January

Q31: The Abrams,Bartle,and Creighton partnership began the process

Q32: Prepare the journal entry for claims of

Q40: In a step acquisition,using the acquisition method

Q50: What is a remainderman?

Q51: After acquiring the additional shares,what adjustment is

Q83: What was the noncontrolling interest in Boat

Q87: With regard to the intercompany sale,which of

Q114: Why would some corporations prefer not to