REFERENCE: Ref.03_07

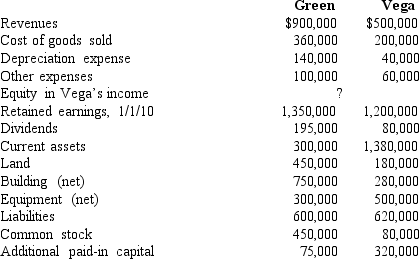

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated revenues.

Definitions:

Meta-analytic

A research method that combines the results of multiple studies to arrive at a comprehensive conclusion.

Cohesion

The degree of camaraderie or bond among members of a group, contributing significantly to its unity and functional success.

Performance

Refers to the act of executing a task or function, often measured against preset known standards of accuracy, completeness, cost, and speed.

Multi-component

Pertains to something that is composed of multiple elements or parts.

Q12: How are bargain purchases different between SFAS

Q14: The gift to David is a<br>A)general legacy.<br>B)specific

Q45: What is consolidated current liabilities as of

Q46: Which of the following statements is true

Q51: What are the three broad sections of

Q53: What amount of federal income tax must

Q58: Which of the following is usually accounted

Q82: Required:<br>Prepare a schedule to show consolidated net

Q90: How would you account for in-process research

Q96: Required:<br>Using the treasury stock approach,prepare a schedule