REFERENCE: Ref.03_07

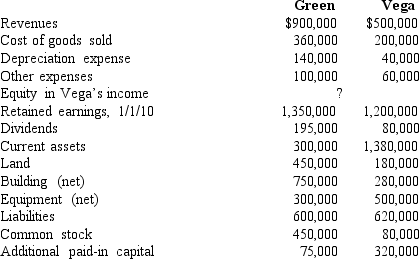

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated common stock.

Definitions:

Liable

Being legally responsible or obligated, especially in terms of financial compensation for damages or injuries.

Manufacturer

is a person or company that makes goods for sale, especially on a large scale, using machinery and labor.

Drunk Driving

The criminal act of operating a vehicle while impaired by alcohol or other drugs, beyond the legal limit.

Negligence

The failure to exercise reasonable care to avoid causing injury or loss to another person, resulting in liability for any damages caused.

Q24: Compute the amount allocated to trademarks recognized

Q28: B Co.owned 70% of the voting common

Q29: Prepare the journal entries to reflect the

Q34: What term,per SFAS 14,is used for an

Q47: What is the purpose of fund-based financial

Q48: A $5,000,000 bond is issued by Northern

Q49: Which of the following types of health

Q56: Salaries and wages that have been earned

Q77: With regard to the intercompany sale,which of

Q93: If the transaction instead occurred on January