REFERENCE: Ref.03_12 Watkins,Inc.acquires All of the Outstanding Stock of Glen Corporation on Corporation

REFERENCE: Ref.03_12

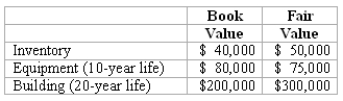

Watkins,Inc.acquires all of the outstanding stock of Glen Corporation on January 1,2009.At that date,Glen owns only three assets and has no liabilities:

-If Watkins issued common stock valued at $410,000 for Glen,rather than paying cash,in a pooling of interests on June 15,1999,at what amount would the subsidiary's Building be represented in a December 31,2009,consolidation,assuming there are no acquisitions or disposals of buildings and equipment?

Definitions:

Lumbar Spine

The lower part of the spine consisting of five vertebrae between the thoracic spine and sacral region, often associated with lower back pain.

Range-Of-Motion (ROM)

The total capacity for movement within a joint, often measured by the extent of its bending and straightening capabilities.

Hemiparesis

A partial weakness on one side of the body, often a result of a stroke or brain injury.

Physiotherapy

A healthcare profession aimed at the treatment, maintenance, and restoration of physical function and mobility.

Q1: What financial schedule would be prepared for

Q10: In consolidation at January 1,2009,what adjustment is

Q15: Under SFAS 141 for purchase Business Combinations,what

Q15: In this month,there were several patients that

Q16: Assuming the combination is accounted for as

Q30: For fund-based financial statements,what account is credited

Q38: What are the five types of governmental

Q63: Bauerly Co.owned 70% of the voting common

Q64: Assume the partial equity method is used.In

Q119: If Cale Corp.had net income of $444,000,exclusive