REFERENCE: Ref.03_15

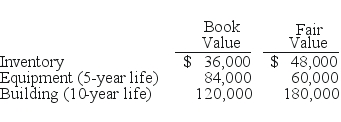

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

-If Utah paid $264,000 in cash for Trimmer,and the original transaction occurred on January 1,2008 under SFAS 141,what allocation should have been assigned to the subsidiary's Building account and its Equipment account in a December 31,2010 consolidation? The fair value of net assets is $288,000.

Definitions:

Null Hypothesis

A hypothesis that there is no significant difference or effect, serving as a default position in hypothesis testing.

Independent Variables

Factors in an experiment that are purposely manipulated to observe their effect on dependent variables.

Durbin-Watson Statistic

A measure used in statistics to detect the presence of autocorrelation in the residuals from a regression analysis.

First-Order Autocorrelation

First-order autocorrelation is a statistical measure indicating the correlation between values in a time series and their immediate predecessors.

Q1: The 2009 total amortization of allocations is

Q12: What would differ between a statement of

Q24: For consolidation purposes,what net debit or credit

Q38: Prepare the journal entry to record the

Q52: Which of the following is usually not

Q57: What is the total noncontrolling interest in

Q58: For governmental entities,the accrual basis of accounting

Q69: Strayten Corp.is a wholly owned subsidiary of

Q82: Which of the following statements is true

Q86: What is meant by unrealized inventory gains,and