REFERENCE: Ref.03_15

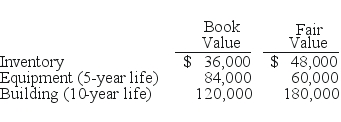

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

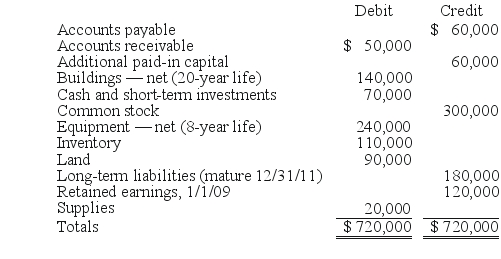

-Matthews Co.obtained all of the common stock of Jackson Co.on January 1,2009.As of that date,Jackson had the following trial balance:

SHAPE \* MERGEFORMAT

During 2009,Jackson reported net income of $96,000 while paying dividends of $12,000.During 2010,Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co.acquired the common stock of Jackson Co.for $588,000 in cash.As of January 1,2009,Jackson's land had a fair value of $102,000,its buildings were valued at $188,000,and its equipment was appraised at $216,000.Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A. )Prepare consolidation worksheet entries for December 31,2009.

(B. )Prepare consolidation worksheet entries for December 31,2010.

Definitions:

Constitution

A written document that outlines the fundamental principles and laws governing a country or organization, establishing the rights and duties of its citizens and the distribution of power.

Expressed Power

Powers explicitly granted to the government or its branches by the constitution.

Receive Ambassadors

The official act of acknowledging and accepting the diplomatic representatives of other nations, typically performed by heads of state or government.

Executive Privilege

The right of the president and other high-level officials to withhold information from Congress, the courts, and ultimately the public.

Q1: A not-for-profit organization receives a computer as

Q2: What is consolidated net income?<br>A)$229,500.<br>B)$237,000.<br>C)$245,000.<br>D)$232,500.<br>E)$240,000.

Q24: Marie Todd works for the City of

Q29: On the consolidated financial statements,what amount should

Q62: Prepare the journal entry for Donald,Chief &

Q67: What are the three departures from SFAS

Q69: Parent Corporation acquired some of its subsidiary's

Q69: Under modified accrual accounting,when should revenues be

Q76: What consolidation entry would have been recorded

Q109: Dalton Corp.owned 70% of the outstanding common