REFERENCE: Ref.03_15

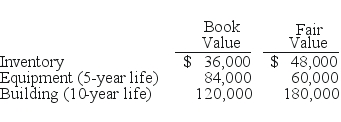

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

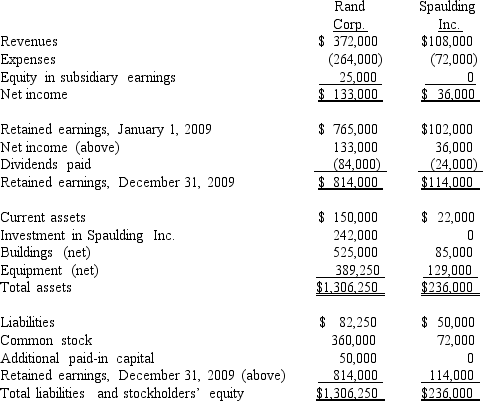

-On January 1,2009,Rand Corp.issued shares of its common stock for all of the outstanding common stock of Spaulding Inc.This combination was accounted for as a purchase.Spaulding's book value was only $140,000 at the time,but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share.Rand was willing to convey these shares because it felt that buildings (ten-year life)were undervalued on Spaulding's records by $60,000 while equipment (five-year life)was undervalued by $25,000.Any excess cost over fair value is assigned to goodwill.

Following are the individual financial records for these two companies for the year ended December 31,2009.

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Watson-Crick Model

A structural model of DNA proposed by James Watson and Francis Crick, illustrating DNA as a double helix composed of two antiparallel strands.

Sugar-Phosphate

Refers to the backbone of DNA and RNA, composed of alternating sugar and phosphate groups that hold together the nucleotide bases.

Ladder

A piece of equipment consisting of a series of bars or steps between two upright lengths of wood, metal, or rope, used for climbing up or down.

Radioactive Sulfur

A form of sulfur that contains isotopes capable of emitting radiation, often used in scientific research to trace chemical and biological processes.

Q12: Which statement below is false?<br>A)The purpose of

Q16: Prescott Corp.owned 90% of Bell Inc. ,while

Q22: Which of the following types of health

Q35: Which statement is false regarding the Balance

Q38: Which one of the following accounts would

Q44: What is the dollar amount of non-controlling

Q58: What amount will be reported for consolidated

Q65: The Arnold,Bates,Carlton,and Delbert partnership was liquidating.It had

Q66: A local partnership was in the process

Q109: Direct combination costs and stock issuance costs