REFERENCE: Ref.03_04

Jans Inc.acquired all of the outstanding common stock of Tysk Corp.on January 1,2009,for $372,000.Equipment with a ten-year life was undervalued on Tysk's financial records by $46,000.Tysk also owned an unrecorded customer list with an assessed fair value of $67,000 and an estimated remaining life of five years.

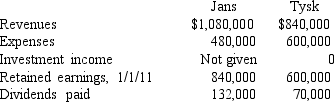

Tysk earned reported net income of $180,000 in 2009 and $216,000 in 2010.Dividends of $70,000 were paid in each of these two years.Selected account balances as of December 31,20011,for the two companies follow.

-If the equity method had been applied,what would be the Investment in Tysk Corp.account balance within the records of Jans at the end of 20011?

Definitions:

Obscure

Difficult to understand or unclear due to being complex or not explicitly stated.

Cessation

The process of bringing or coming to an end; a halt or cessation.

Finitude

The quality or condition of having limits or bounds.

Trepanning

An ancient medical procedure that involves drilling a hole into the human skull for therapeutic or surgical purposes.

Q12: What would differ between a statement of

Q14: The gift to David is a<br>A)general legacy.<br>B)specific

Q15: Compute Collins' share of Smeder's net income

Q32: In consolidation at December 31,2009,what adjustment is

Q35: Why is push-down accounting a popular internal

Q47: Jet Corp.acquired all of the outstanding shares

Q52: Jansen Inc.acquired all of the outstanding common

Q100: Compute Whitton's accrual-based consolidated net income for

Q105: Britain Corporation acquires all of English,Inc.for $800,000

Q109: Dalton Corp.owned 70% of the outstanding common