REFERENCE: Ref.03_07

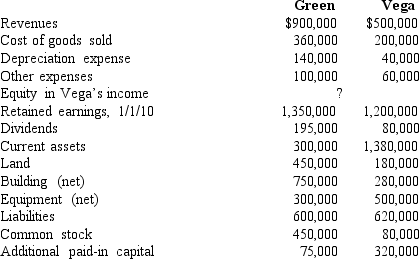

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the book value of Vega at January 1,2006.

Definitions:

Uptake Study

An Uptake Study is a medical test used to assess the functioning of specific organs by measuring the absorption of a radioactive substance.

Radioactive Substance

A material that emits radiation, resulting from the decay of atomic nuclei, used in various medical, industrial, and research applications.

Organ

A part of the body constructed of many types of tissue to perform a function.

Therapeutic Radiation

Used in the treatment of cancer by preventing cellular reproduction.

Q1: Webb Co.acquired 100% of Rand Inc.on January

Q3: What are the three categories of net

Q8: Assuming that Musial owned only 90% of

Q14: For an acquisition when the subsidiary retains

Q25: When comparing the difference between an upstream

Q52: .The City of Wetteville has a fiscal

Q58: Consolidated net income using the equity method

Q75: Which of the following statements is true?<br>A)Alpha

Q112: Hambly Corp.owned 80% of the voting common

Q114: Assume the partial equity method is applied.How