REFERENCE: Ref.03_07

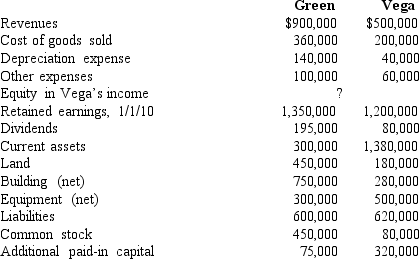

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated common stock.

Definitions:

Adjustment Message

Communication intended to address a complaint or request, aiming to rectify an issue and maintain customer satisfaction.

Sympathy Note

A written message expressing feelings of condolence and support for someone who has experienced loss or misfortune.

Communication Channel

The medium through which information is transmitted from sender to receiver, such as email, phone, or face-to-face.

Customer Complaints

Feedback from customers expressing dissatisfaction with a product or service.

Q9: The estate of Bobbi Jones has the

Q10: Which of the following will be included

Q18: Burnside Corp.is organized into four operating segments.The

Q52: On July 12,2008,Fred City ordered a new

Q56: How does a gain on an intercompany

Q60: Which of the following statements is true

Q93: In a transaction accounted for using the

Q104: Which of the following statements is false

Q113: Prepare the journal entries to record (1)the

Q119: What amount will be reported for consolidated