REFERENCE: Ref.03_07

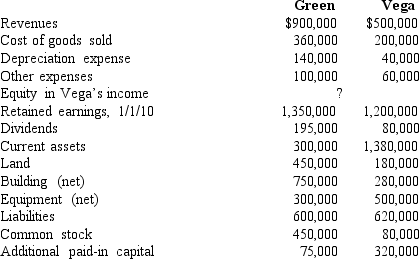

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated additional paid-in capital.

Definitions:

Job Adjustment

The process of adapting or accommodating to the requirements and conditions of a specific job or workplace environment.

Skill Learning

The process of acquiring new skills or improving existing ones through practice, training, or experience, often essential for personal and professional development.

Career Advancement

Career advancement refers to the progress and growth a person experiences in their professional life, often through promotions, learning new skills, or taking on more responsibilities.

Employee Commitment

The level of enthusiasm, loyalty, and the willingness of employees to invest effort in their organization's goals.

Q1: The city operates a public pool where

Q6: How does a voluntary health and welfare

Q16: What is the purpose of a predistribution

Q25: Proprietary funds are<br>A)Funds used to account for

Q53: Compute the amount of Hurley's land that

Q62: All of the following are potential losses

Q64: How is goodwill amortized?<br>A)It is not amortized

Q72: Which of the following statements is false

Q76: What consolidation entry would have been recorded

Q98: The noncontrolling interest in the net income