REFERENCE: Ref.03_14

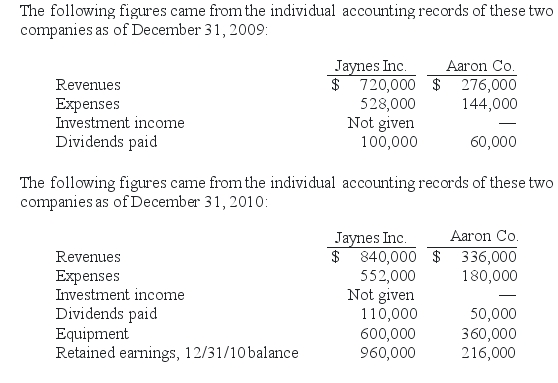

Jaynes Inc.obtained all of Aaron Co.'s common stock on January 1,2009,by issuing 11,000 shares of $1 par value common stock.Jaynes' shares had a $17 per share fair value.On that date,Aaron reported a net book value of $120,000.However,its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records.Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

SHAPE \* MERGEFORMAT

-If this combination is viewed as an acquisition,what was consolidated equipment as of December 31,2010?

Definitions:

Grasping

The action of taking hold of something firmly with the hands or utilizing tools to obtain or gather something.

Cutting

The act of making an incision or dividing materials into parts using a sharp tool.

Dilating/probing

The act of expanding or opening wider a body part, often combined with an examination to explore or investigate.

Jewelry

Decorative items worn for personal adornment, such as rings, earrings, bracelets, and necklaces, often made of precious metals and stones.

Q1: The city operates a public pool where

Q10: How is the Statement of Cash Flows

Q12: Which statement below is false?<br>A)The purpose of

Q16: Kordel Inc.holds 75% of the outstanding common

Q21: What is a marshaling of assets?<br>A)a listing

Q23: If the noncash assets were sold for

Q30: What are the four fiduciary fund types?

Q47: Determine the cash to be retained and

Q67: What was Cleary's share of income for

Q77: Compute the consolidated cash upon completion of