REFERENCE: Ref.03_15

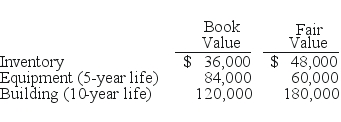

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

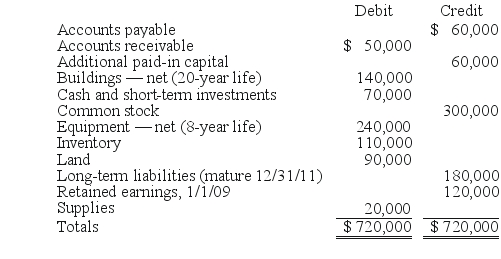

-Matthews Co.obtained all of the common stock of Jackson Co.on January 1,2009.As of that date,Jackson had the following trial balance:

SHAPE \* MERGEFORMAT

During 2009,Jackson reported net income of $96,000 while paying dividends of $12,000.During 2010,Jackson reported net income of $132,000 while paying dividends of $36,000.

Assume that Matthews Co.acquired the common stock of Jackson Co.for $588,000 in cash.As of January 1,2009,Jackson's land had a fair value of $102,000,its buildings were valued at $188,000,and its equipment was appraised at $216,000.Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.

Matthews decided to use the equity method for this investment.

Required:

(A. )Prepare consolidation worksheet entries for December 31,2009.

(B. )Prepare consolidation worksheet entries for December 31,2010.

Definitions:

Physical Appearance

Physical appearance refers to the observable traits of an individual, including bodily shape, facial features, and other physical characteristics, which can influence social perceptions and interactions.

Cause-Effect Relationship

The principle that there is a direct relationship between an event (the cause) and its consequence (the effect).

Experiment

A methodical process conducted to uncover new findings, verify a theory, or prove an established truth.

Operational Definition

A clear, detailed description of how variables in a study are measured or manipulated, ensuring replicability and clarity in research.

Q13: Compute the income tax payable by White

Q15: A demonstrative legacy is a<br>A)gift of personal

Q21: A gift that is specified in a

Q28: Compute the amount of Hurley's land that

Q38: Compute consolidated land at date of acquisition.<br>A)$2,060.<br>B)$1,800.<br>C)$260.<br>D)$2,050.<br>E)$2,070.

Q39: Unconditional transfers of cash or other resources

Q41: Safire Corp.recently acquired $500,000 of the bonds

Q59: What balances would need to be considered

Q70: Assuming the combination is accounted for as

Q91: What is the amount of taxable income