REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

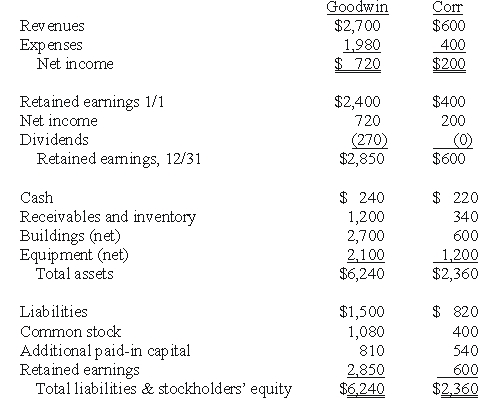

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-If the combination is accounted for as an acquisition,at what amount is the investment recorded on Goodwin's books?

Definitions:

Western Electric Company

A historical telecommunications company that played a pivotal role in the development and manufacture of telephone and electrical equipment, notably conducting the Hawthorne Studies which had a foundational impact on organizational behavior studies.

Lucent Technologies

was a multinational telecommunications equipment company, known for its innovations in optical, data, and voice networking technology, before merging with Alcatel in 2006.

Managerial Ethics

Refers to the moral principles and standards that guide the behavior of individuals in managerial positions, influencing their decision-making and leadership practices.

Corporate Social Responsibility

A business model that incorporates self-regulation into a company's business model to ensure its activities have a positive impact on society, the environment, and the economy.

Q14: Compute the noncontrolling interest in the net

Q19: What amount of goodwill should be attributed

Q19: What events or circumstances might force the

Q24: What was Thurman's share of income or

Q28: What is the non-controlling interest's share of

Q34: Compute the amount of Hurley's equipment that

Q39: The Town of Anthrop has recorded the

Q47: The town of Conway opened a solid

Q58: Eden acquired a 20% interest in the

Q93: Assume that Icecap sold inventory to Polar