REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

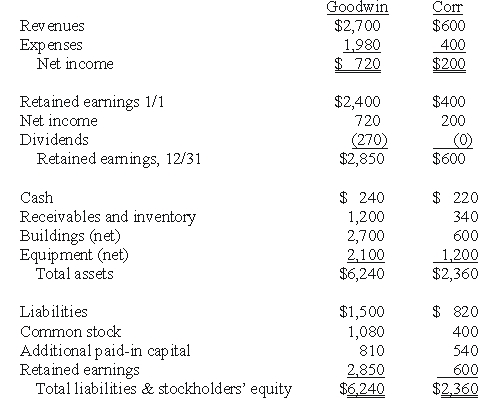

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as a purchase,compute the consolidated expenses for 20X1.

Definitions:

Tracking Ball

A technique or device used to monitor the trajectory or location of a ball within sports or other contexts.

Product Feature

A distinguishing attribute or characteristic of a product, often used in marketing to highlight its uniqueness or advantage over competitors.

Preconscious Need Level

The level at which needs are not fully developed in the conscious mind.

Post-purchase Dissonance

The feeling of regret, doubt, or anxiety that a consumer may experience after making a significant purchase, fearing that they may have made the wrong choice.

Q4: For an acquisition when the subsidiary retains

Q7: What is meant by estate accounting?

Q8: What is the total acquisition-date fair value

Q11: What was the balance in Eaton's Capital

Q13: Harding,Jones,and Sandy is in the process of

Q24: The partnership of Nurr,Cleamons,and Kelly was insolvent,as

Q33: What events cause the dissolution of a

Q43: Which of the following is a new

Q45: A parent company owns a 70 percent

Q56: What consolidation entry would have been recorded