REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

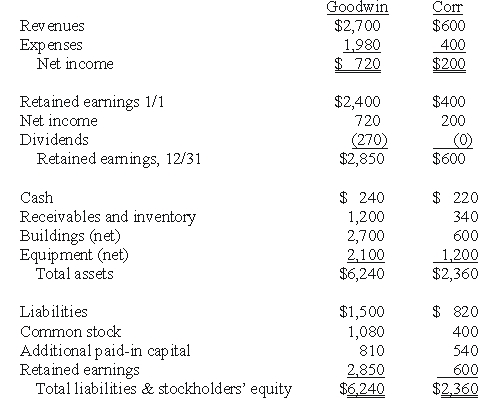

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as an acquisition,compute the consolidated expenses for 20X1.

Definitions:

Statute of Frauds

A legal principle that requires certain types of contracts to be executed in writing and signed by the party to be charged, to be enforceable.

Lease Term

The duration of a lease agreement, specifying the start and end dates of the tenancy.

Tenancy at Sufferance

A situation where a tenant continues to occupy the property after the lease term has ended, without the express permission of the landlord.

Holdover Tenant

A tenant who continues to occupy property after the expiration of their lease, without the landlord's express permission.

Q9: Required:<br>Prepare a schedule to show Kurton's share

Q15: What is the adjusted book value of

Q20: On January 1,2008,Wakefield City purchased $40,000 office

Q21: Property taxes of 1,500,000 are levied for

Q26: For each of the following situations,select the

Q27: What are the two proprietary fund types?

Q43: If the parent's net income reflected use

Q50: What is Pi's accrual-based income for 2009?<br>A)$152,000.<br>B)$16,000.<br>C)$192,000.<br>D)$200,000.<br>E)$208,000.

Q80: The following are preliminary financial statements for

Q90: Wolff Corporation owns 70 percent of the