REFERENCE: Ref.02_04 on January 1,20X1,the Moody Company Entered into a Transaction for Transaction

REFERENCE: Ref.02_04

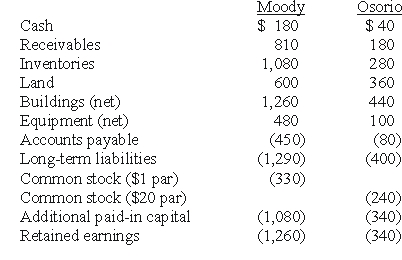

On January 1,20X1,the Moody company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this purchase.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated buildings (net) at date of combination.

Definitions:

Resources

Resources refer to materials, money, staff, and other assets that can be used by an organization or individual to achieve specific goals or conduct operations.

Sustained Competitive Advantage

The long-term ability of a company to remain more competitive than its rivals by maintaining unique value propositions.

Training And Reward

The process of providing employees with the necessary skills for their roles and incentivizing them with various forms of compensation or recognition.

Talent

The innate abilities, skills, and expertise that individuals possess, which can be leveraged to meet organizational goals.

Q14: Reciprocal transfers where both parties give and

Q16: What is the difference between an executor

Q21: Property taxes of 1,500,000 are levied for

Q21: What is the new percent ownership Ryan

Q28: Net cash flow from operating activities was:<br>A)$92,000.<br>B)$27,000.<br>C)$63,000.<br>D)$29,000.<br>E)$33,000.

Q52: Compute Simon's share of income from Wilson

Q55: The estate of Kent Talbert reported the

Q57: Which entry would be the correct entry

Q71: Fine Co.issued its common stock in exchange

Q93: If the transaction instead occurred on January