REFERENCE: Ref.02_06

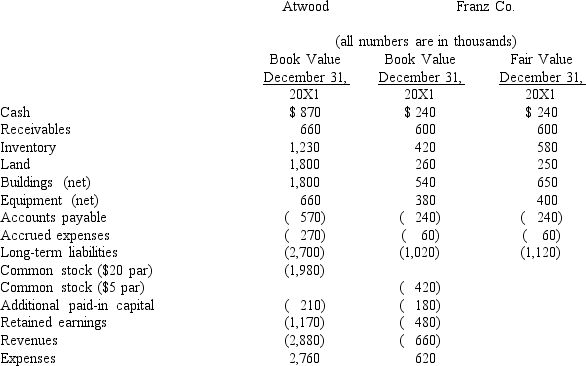

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Compute consolidated buildings (net) at the date of the business combination.

Definitions:

Social Networking

The use of internet-based platforms to build social networks or social relations among people who share interests, activities, backgrounds, or real-life connections.

Digital Citizenship

The responsible use of technology by anyone who uses computers, the internet, and digital devices to engage with society on any level.

Digital Footprint

The trace or record left by an individual's activities in a digital environment, including internet usage, social media presence, and online transactions.

Profanity on Social Media

Refers to the use of offensive language or swear words in posts, comments, or interactions on social media platforms.

Q20: Record the journal entries that reflect all

Q27: Prepare Panton's journal entry to recognize the

Q33: If the transaction is accounted for as

Q38: Compute consolidated land at date of acquisition.<br>A)$2,060.<br>B)$1,800.<br>C)$260.<br>D)$2,050.<br>E)$2,070.

Q48: The life insurance policy was collected.<br>Prepare the

Q51: The partnership of Rayne,Marin,and Fulton was being

Q52: Compute Simon's share of income from Wilson

Q71: What is the balance in Investment in

Q71: According to GASB Concepts Statement No.1,what are

Q90: If Utah paid $300,000 in cash for