REFERENCE: Ref.02_06

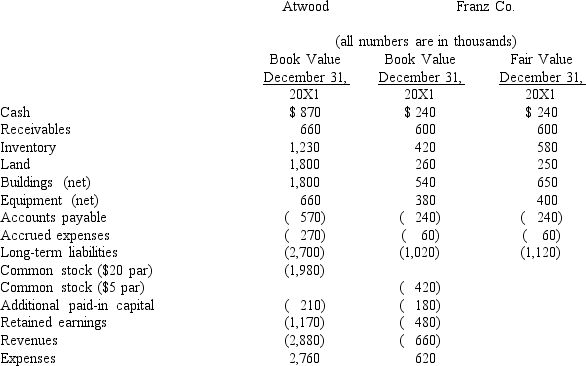

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Assuming the combination is accounted for as a purchase,compute consolidated expenses at the date of the combination.

Definitions:

GDP

Gross Domestic Product; a measure of the economic production and growth of a country, representing the total value of all goods and services produced over a specific time period.

Regulatory Protein

Proteins that play crucial roles in controlling gene expression and mediating cellular activities.

G Protein

A class of proteins that act as molecular switches inside cells, involved in transmitting signals from various stimuli outside a cell to its interior.

Receptor Molecules

Proteins located on the cell surface or within cells that bind specific substances, triggering a biological response.

Q21: A gift that is specified in a

Q21: Explain how the treasury stock approach treats

Q27: What are the two proprietary fund types?

Q28: A gift of any remaining property is

Q34: The Keaton,Lewis,and Meador partnership had the following

Q49: Which of the following types of health

Q55: Which of the following statements is false

Q63: The following account balances were available for

Q82: Which of the following statements is true

Q98: What amount will be reported for consolidated