REFERENCE: Ref.02_08

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1,20X1.To obtain these shares,Flynn pays $400 (in thousands) and issues 10,000 shares of $20 par value common stock on this date.Flynn's stock had a fair value of $36 per share on that date.Flynn also pays $15 (in thousands) to a local investment firm for arranging the transaction.An additional $10 (in thousands) was paid by Flynn in stock issuance costs.

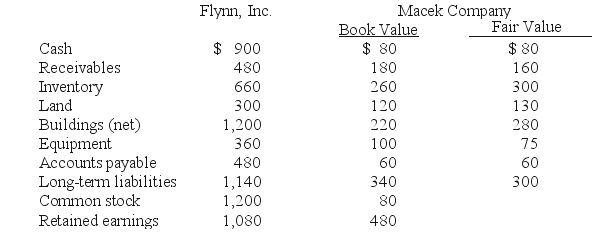

The book values for both Flynn and Macek as of January 1,20X1 follow.The fair value of each of Flynn and Macek accounts is also included.In addition,Macek holds a fully amortized trademark that still retains a $40 (in thousands) value.The figures below are in thousands.Any related question also is in thousands.

SHAPE \* MERGEFORMAT

-What amount will be reported for consolidated common stock?

Definitions:

Cash Flow

The total amount of money being transferred into and out of a business, crucial for understanding its liquidity, solvency, and financial health.

Information Flow

The movement or exchange of data, knowledge, and insights among people, processes, or systems within or across organizations.

Outsourcing

The business practice of hiring a party outside a company to perform services or create goods that were traditionally performed in-house by the company's own employees and staff.

Obtaining Materials

The process of sourcing and procuring the raw materials needed for production or manufacturing.

Q5: The employees of the City of Raymond

Q30: For fund-based financial statements,what account is credited

Q32: Free assets after payment of liabilities with

Q41: Jipsom and Klark were partners with capital

Q47: Jet Corp.acquired all of the outstanding shares

Q47: What is the purpose of fund-based financial

Q61: What is the new percent ownership of

Q64: What is the meaning of the phrase

Q75: What was Kuried's balance in the Investment

Q76: Assume that Botkins acquired Volkerson as a