REFERENCE: Ref.02_08

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1,20X1.To obtain these shares,Flynn pays $400 (in thousands) and issues 10,000 shares of $20 par value common stock on this date.Flynn's stock had a fair value of $36 per share on that date.Flynn also pays $15 (in thousands) to a local investment firm for arranging the transaction.An additional $10 (in thousands) was paid by Flynn in stock issuance costs.

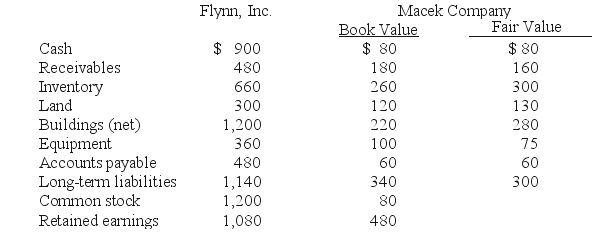

The book values for both Flynn and Macek as of January 1,20X1 follow.The fair value of each of Flynn and Macek accounts is also included.In addition,Macek holds a fully amortized trademark that still retains a $40 (in thousands) value.The figures below are in thousands.Any related question also is in thousands.

SHAPE \* MERGEFORMAT

-What amount will be reported for consolidated cash after the purchase transaction?

Definitions:

Producers

Individuals or businesses involved in the creation of goods and services for sale in the market.

Market Structure

The organizational and other characteristics of a market that influence the nature of competition and pricing.

Oligopolistic Industry

A market structure dominated by a small number of large firms, leading to limited competition and potentially higher prices for consumers.

Coca-Cola

A carbonated soft drink brand that is recognized worldwide, known for its secret formula and wide range of flavors.

Q2: What are the objectives of accounting for

Q14: The gift to David is a<br>A)general legacy.<br>B)specific

Q14: For an acquisition when the subsidiary retains

Q15: On June 14,2008,Fred City agreed to transfer

Q23: Which entry would be the correct entry

Q27: Prepare the journal entry to record interest

Q33: What is the amount of the personal

Q65: When a company applies the partial equity

Q65: Net cash flow from operating activities was:<br>A)$44,000.<br>B)$44,800.<br>C)$46,200.<br>D)$50,000.<br>E)$52,200.

Q111: Which of the following is not an