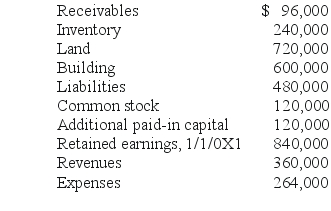

Jernigan Corp.had the following account balances at 12/31/X1:

SHAPE \* MERGEFORMAT

Several of Jernigan's accounts have fair values that differ from book value: Land - $480,000;Building - $720,000;Inventory - $336,000;and Liabilities - $396,000.

Inglewood Inc.obtained all of the outstanding common shares of Jernigan by issuing 20,000 shares of common stock having a $6 par value,but a $66 fair value.Stock issuance costs amounted to $12,000.

Required:

Prepare a fair value allocation and goodwill schedule at the date of the combination.

Definitions:

Q8: When a city collects fees from citizens

Q11: Assuming the combination is accounted for as

Q36: Prepare the consolidation entries that should be

Q45: What is consolidated current liabilities as of

Q62: Yoderly Co. ,a wholly owned subsidiary of

Q69: In settling an estate,what is the meaning

Q78: What accounting method requires a subsidiary to

Q79: How should a company undergoing reorganization report

Q113: All of the following are acceptable methods

Q119: If Cale Corp.had net income of $444,000,exclusive