Figure:

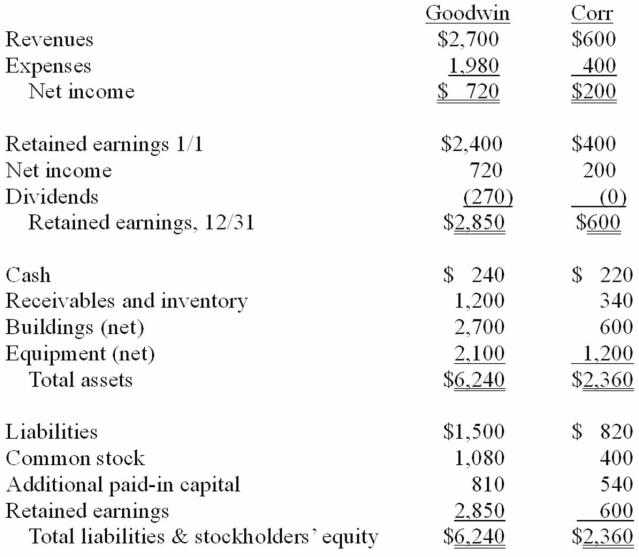

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated revenues for 20X1.

Definitions:

Parental Nurture

The care, love, and support that parents provide to their offspring, significantly impacting their emotional and physical development.

Insecure Attachment

A pattern of attachment in which individuals are unable to form stable and trusting relationships with others, often due to early negative experiences with caregivers.

Temperament

An individual's natural predisposition towards emotional reactivity and intensity, often observable from early in life.

Critical Periods

Specified times during early life when the development of specific abilities, skills, or knowledge occurs most readily.

Q10: Where does the noncontrolling interest in Stage's

Q20: On the consolidated financial statements,what amount should

Q23: Which of the following is not a

Q33: Compute the noncontrolling interest in the net

Q34: Compute the amount of Hurley's equipment that

Q35: Which statement is false regarding the Balance

Q39: Compute the noncontrolling interest in Gargiulo's net

Q50: Which of the following will be included

Q58: Which of the following is usually accounted

Q93: In a transaction accounted for using the