REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

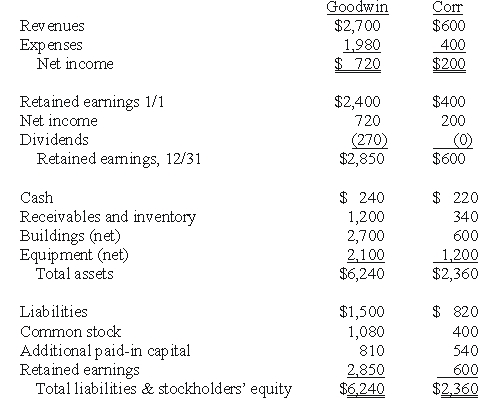

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as an acquisition,compute the consolidated expenses for 20X1.

Definitions:

Credits

Entries on the right-hand side of an accounting ledger, indicating increases in liability, equity accounts, and revenue, or a decrease in assets.

Debit Side

The left side of a ledger account that is used to record increases in assets, expenses, and decreases in liabilities, equity, and income.

Asset Accounts

Ledger accounts that record a company's owned resources with economic value expected to provide future benefits.

Compound Entry

An accounting entry that involves more than two accounts, where there are multiple debits, credits, or both.

Q14: For an acquisition when the subsidiary retains

Q17: Stevens Company has had bonds payable of

Q18: Assuming the combination is accounted for as

Q26: What is the total noncontrolling interest in

Q33: What should Dura Foundation report as program

Q37: What is the dollar amount of Float

Q41: If the transaction is accounted for as

Q45: What is consolidated current liabilities as of

Q74: What theoretical argument could be made against

Q113: Prepare the journal entries to record (1)the