Figure:

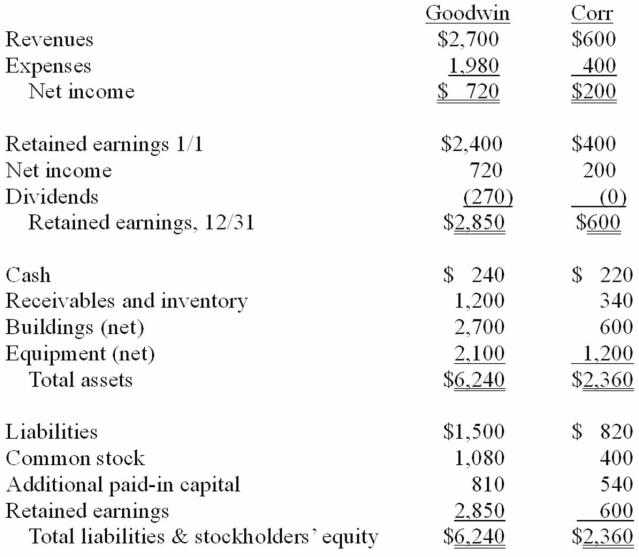

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated cash account at December 31, 20X1.

Definitions:

Forward Looking

An approach or attitude that is focused on future developments, planning, or innovations rather than solely on current or past situations.

Modern

Pertaining to the current time or most recent period; often associated with being up-to-date, innovative, or advanced.

Negative Stereotype

A generalized and negative assumption made about a group, often leading to prejudice and discrimination.

Gen Y

A demographic cohort also known as Millennials, typically born between the early 1980s and the late 1990s.

Q8: What is the total acquisition-date fair value

Q10: When a city received a federal grant

Q12: Under the partial equity method,the parent recognizes

Q14: What is the adjusted book value of

Q38: Polar sold a building to Icecap on

Q44: A Chapter 7 bankruptcy is a(n)<br>A)Involuntary reorganization.<br>B)bankruptcy

Q48: A not-for-profit organization provides the following information

Q67: If the partial equity method has been

Q87: Compute the consolidated common stock account at

Q89: Assume that Bullen paid a total of