Figure:

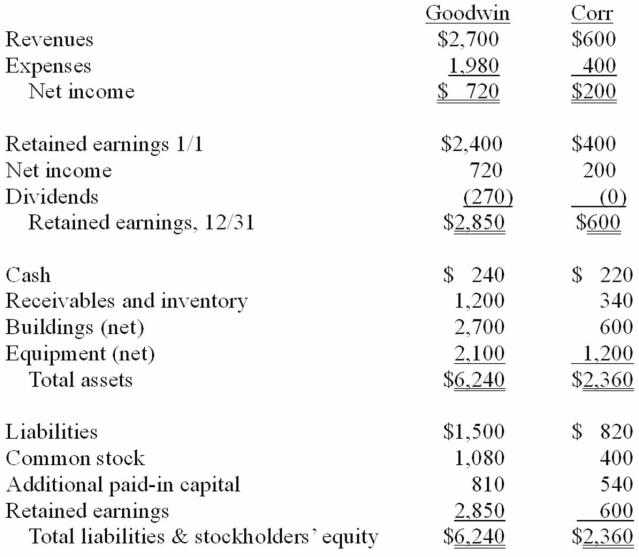

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated buildings (net) account at December 31, 20X1.

Definitions:

Riots

Violent disturbances of the peace by a crowd, often a protest against policies or actions.

Shared Focus

A situation where all members of a group concentrate their efforts and attention on a common objective or goal.

Disperse

To scatter or spread out from a common point to various directions, often referring to groups or particles.

Crowd

A large number of people gathered together, typically in a disorganized or unruly way.

Q5: When a parent uses the equity method

Q10: Cherryhill and Hace had been partners for

Q13: What is the new total balance of

Q17: Compute Stark's reported gain or loss relating

Q21: Which of the following is not a

Q52: If a subsidiary issues a stock dividend,which

Q65: When a company applies the partial equity

Q75: What was Wasser's share of income for

Q100: Tara Company holds 80 percent of the

Q111: Bale Co.acquired Silo Inc.on October 1,20X1,in a