REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

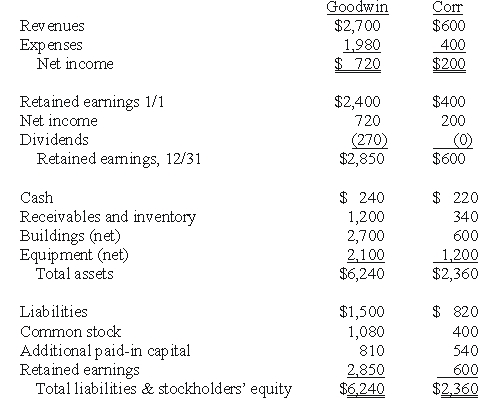

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as an acquisition,compute the consolidated goodwill account at December 31,20X1.

Definitions:

Virtual Meetings

Meetings conducted over the internet using video conferencing tools, allowing participants to interact without being physically present.

Videoconferencing

A technology that allows people in different locations to hold face-to-face meetings without having to move to a single location physically.

Telepresence

Telepresence refers to technology-enabled services that allow people to feel or appear as if they are present in a location different from their actual one.

Destructive Feedback

Criticism or feedback that is harsh, negative, and not constructive, often leaving the recipient feeling demoralized or discouraged.

Q15: What is the adjusted book value of

Q25: Proprietary funds are<br>A)Funds used to account for

Q35: Prepare the journal entry for Donald,Chief &

Q37: How are direct combination costs accounted for

Q42: What is the primary difference between monies

Q57: How much would James have received from

Q74: Compute the income from Gargiulo reported on

Q80: A parent acquires all of a subsidiary's

Q85: Compute Parker's reported gain or loss relating

Q85: Net cash flow from financing activities was:<br>A)$(61,000).<br>B)$(96,000).<br>C)$(100,000).<br>D)$(80,000).<br>E)$(99,000).