REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

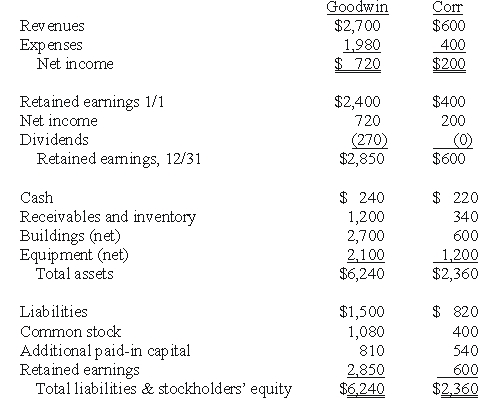

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming the combination is accounted for as an acquisition,compute the consolidated retained earnings at December 31,20X1.

Definitions:

Brown v. Board

A landmark United States Supreme Court case in 1954 that declared state laws establishing separate public schools for black and white students to be unconstitutional.

Roe v. Wade

The 1973 U.S. Supreme Court decision that established a woman's legal right to an abortion.

Legal Precedents

Past court decisions that are used as a guide in interpreting and applying the law in future cases.

Judicial Precedents

Decisions from previous court cases which are used as a guide for judging similar future cases, establishing consistency in legal reasoning.

Q1: Parent Corporation recently acquired some of its

Q10: Which statement below is not correct?<br>A)The accounting

Q10: Xygote,Yen,and Zen were partners who were liquidating

Q12: How are bargain purchases different between SFAS

Q22: Which group of governmental financial statements reports

Q32: What was Nolan's capital balance at the

Q37: How are direct combination costs accounted for

Q64: What was Thurman's share of income or

Q109: Horse Corporation acquires all of Pony,Inc.for $300,000

Q118: If Goehler applies the initial value method