Figure:

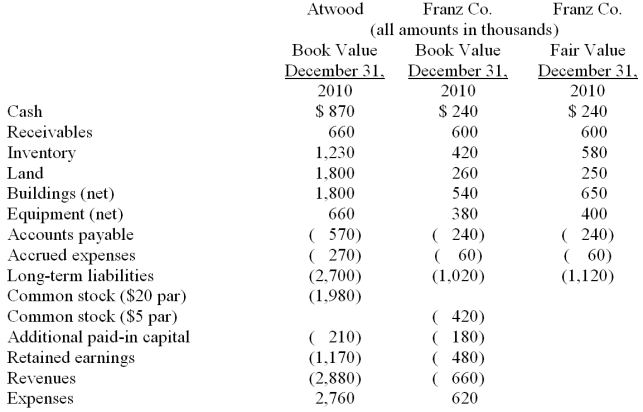

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2010, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2010. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated equipment at date of acquisition.

Definitions:

Encoding

The process of converting information into a form that can be stored in memory, part of how information is processed and retained.

Information-Processing Approach

A perspective in cognitive psychology that examines how humans interpret, store, and retrieve knowledge, paralleling human thought processes to computer operations.

Processing Limitations

Refers to the bounds on the ability of individuals to process information, due to various cognitive or neural constraints.

Self-Motivation

The internal drive or initiative that leads an individual to act or pursue goals without external influence or reward.

Q3: Clemente Co.owned all of the voting common

Q20: Using the indirect method,where does the decrease

Q24: What was Thurman's share of income or

Q25: The city of Nextville operates a motor

Q25: When Danny withdrew from John,Daniel,Harry,and Danny LLP,he

Q38: What are the five types of governmental

Q45: Prepare a schedule to calculate the safe

Q52: According to SFAS No.141,the pooling of interest

Q52: On July 12,2008,Fred City ordered a new

Q84: Goehring,Inc.owns 70 percent of Harry,Inc.The consolidated income