REFERENCE: Ref.02_07

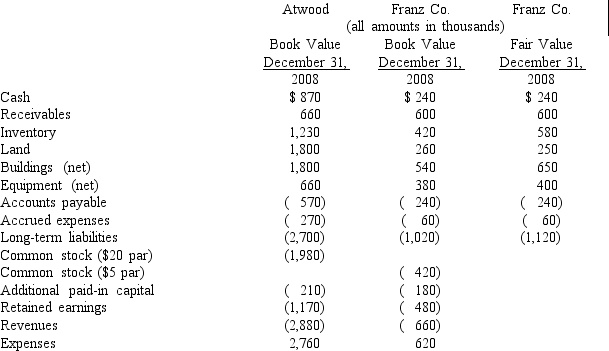

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31,2009,immediately before Atwood acquired Franz.Also included are the fair values for Franz Company's net assets at that date.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,2009.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Atwood is applying the acquisition method in accounting for Franz.To settle a difference of opinion regarding Franz's fair value,Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year.Given the probability of the required contingency payment and utilizing a 4% discount rate,the expected present value of the contingency is $5 (in thousands) .

-Compute consolidated expenses at date of acquisition.

Definitions:

Biological Methods

Techniques and processes used in the biological sciences, often for research, conservation, or managing natural resources, involving living organisms or derivatives thereof.

Bacteria Killed

Refers to the elimination or death of bacteria, typically through physical or chemical means such as disinfection or antibiotics.

Floating Objects

Items that are able to remain on the surface of a liquid or in the atmosphere due to the principles of buoyancy or air currents.

Pollution Tolerance

The ability of an organism or a species to withstand pollution in its environment without suffering significant adverse effects.

Q5: The employees of the City of Raymond

Q8: The city of Kamen collected $17,000 from

Q24: Marie Todd works for the City of

Q46: What is the preferred method of resolving

Q54: Compute goodwill,if any,at January 1,2009.<br>A)$150.<br>B)$250.<br>C)$700.<br>D)$1,200.<br>E)$550.

Q55: Assume that Bullen issued 12,000 shares of

Q71: According to GASB Concepts Statement No.1,what are

Q91: When Ryan's new percent ownership is rounded

Q104: Compute the December 31,2010,consolidated land.<br>A)$220,000.<br>B)$180,000.<br>C)$670,000.<br>D)$630,000.<br>E)$450,000.

Q111: What advantages might push-down accounting offer for