REFERENCE: Ref.19_03

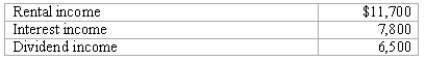

During the most recent year,an estate generated income of $26,000:  The interest income was conveyed immediately to the beneficiary stated in the decedent's will.Dividends of $1,560 were given to the decedent's church.

The interest income was conveyed immediately to the beneficiary stated in the decedent's will.Dividends of $1,560 were given to the decedent's church.

-What amount of federal income tax must be paid?

Definitions:

Deferred

Postponed or delayed, often referring to income or expenses that are recognized in a later accounting period.

Net Operating Income

The profit realized from a business's operations after subtracting all operating expenses except interest and taxes.

Variable Costing

An accounting method that includes only variable production costs (materials, labor, and overhead) in product costs, excluding fixed overhead costs.

Unit Product Cost

The total cost attributed to producing one unit of product, including direct materials, direct labor, and allocated manufacturing overhead.

Q3: A local partnership has assets of cash

Q3: Clemente Co.owned all of the voting common

Q10: Cherryhill and Hace had been partners for

Q14: Dutch Co.has loaned $90,000 to its subsidiary,Hans

Q18: Davidson,Inc.owns 70 percent of the outstanding voting

Q39: The SEC has usually restricted its role

Q46: Which of the following statements is required

Q47: Jet Corp.acquired all of the outstanding shares

Q58: What amount will be reported for consolidated

Q100: Under the partial equity method of accounting