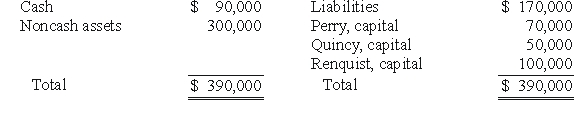

.The following account balances were available for the Perry,Quincy,and Renquist partnership just before it entered liquidation:

Perry,Quincy,and Renquist had shared profits and losses in a ratio of 2:4:4.Liquidation expenses were expected to be $8,000.

Assume that Quincy was insolvent and could not contribute assets to cover any deficit in her capital account.For what amount must the noncash assets have been sold,so that Renquist would have received some cash from the liquidation?

Definitions:

Poisson Distribution

A probability distribution that models the number of times an event occurs in a fixed interval of time or space.

Fast Food Restaurant

A type of restaurant that offers quick service, a limited menu, and food prepared in a pre-cooked or quick-cooking manner.

Customers Arrive

Describes the occurrence or rate at which clients or consumers come to a service area, influencing service system design and capacity planning.

Diesel-Generator Sets

Machines that convert diesel fuel into electricity, typically used for power generation in places without access to the grid.

Q5: Bay City received a federal grant to

Q10: Which statement below is not correct?<br>A)The accounting

Q23: James,Keller,and Rivers have the following capital balances;$48,000,$70,000

Q53: What amount of federal income tax must

Q58: Which information is not contained in the

Q61: Compute the amount of the patent reported

Q64: At the date of pooling,by how much

Q69: What is Form 10-K?<br>A)a quarterly report filed

Q78: What accounting method requires a subsidiary to

Q120: What amount will be reported for consolidated