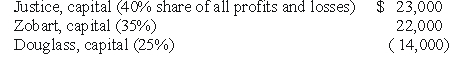

.A local partnership was in the process of liquidating and reported the following capital balances:

Douglass indicated that the $14,000 deficit would be covered by a forthcoming contribution.However,the two remaining partners asked to receive the $31,000 that was then available.

How much of this money should Zobart receive?

Definitions:

Single-use Plans

Plans developed to achieve a set of goals that are not intended to be repeated in the future, specific to a unique situation.

Standing Plans

Refers to established policies, procedures, and rules that provide a basis for decision-making and action in recurring situations.

Project Schedule

A planned timeline for the tasks and milestones involved in completing a project, often depicted in a Gantt chart or similar tool.

Task Objectives

Specific goals set for the completion of a task, focusing on outcomes, efficiency, and the quality of the work done.

Q10: Consolidations subsequent to the date of combination

Q14: Which of the following could be used

Q22: The Henry,Isaac,and Jacobs partnership was about to

Q31: Which adjustment would be made to change

Q33: If the transaction is accounted for as

Q35: Briefly describe Regulation S-K.What is its purpose?

Q53: A company has been using the fair-value

Q71: Roberts retires and is paid $160,000 based

Q78: A statement of financial affairs created for

Q91: When an investor sells shares of its