REFERENCE: Ref.15_03 Hardin,Sutton,and Williams Has Operated a Local Business as a Partnership

REFERENCE: Ref.15_03

Hardin,Sutton,and Williams has operated a local business as a partnership for several years.All profits and losses have been allocated on a 3:2:1 ratio,respectively.Recently,Williams has undergone personal financial problems,and is insolvent.To satisfy Williams' creditors,the partnership has decided to liquidate.

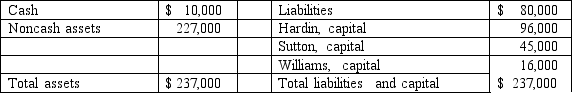

The following balance sheet has been produced:

During the liquidation process,the following transactions take place:

During the liquidation process,the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid.No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

-Jones,Marge,and Tate LLP decided to dissolve and liquidate the partnership on September 31,2009.After realization of a portion of the noncash assets,the capital account balances were Jones $50,000;Marge $40,000;and Tate $15,000.Cash of $35,000 and other assets with a carrying amount of $100,000 were on hand.Creditors' claims totaled $30,000.Jones,Marge,and Tate shared net income and losses in a 2:1:1 ratio,respectively.

Prepare a working paper to compute the amount of cash that may be paid to creditors and to partners at this time,assuming that no partner is solvent.

Definitions:

Break-Even Point

The level of production or sales at which total revenues equal total expenses, resulting in neither a profit nor a loss.

Pretax Income

The amount of income earned by a business before tax is deducted, also known as earnings before tax (EBT).

Unit Sales Price

The price at which a single unit of a product is sold.

Unit Variable Cost

The cost associated with producing one additional unit of a product, including materials, labor, and other variable expenses.

Q5: What is a company's functional currency?<br>A)the currency

Q40: For a partnership,how should liquidation gains and

Q42: What is the primary difference between monies

Q42: The goals of the SEC include all

Q57: If Watkins pays $450,000 in cash for

Q58: Which information is not contained in the

Q58: Eden acquired a 20% interest in the

Q59: Assume that Bullen issued 12,000 shares of

Q77: Which of the following is not a

Q120: What amount will be reported for consolidated