REFERENCE: Ref.13_07 Mount Inc.was a Hardware Store That Operated in Boise,Idaho.Management Made

REFERENCE: Ref.13_07

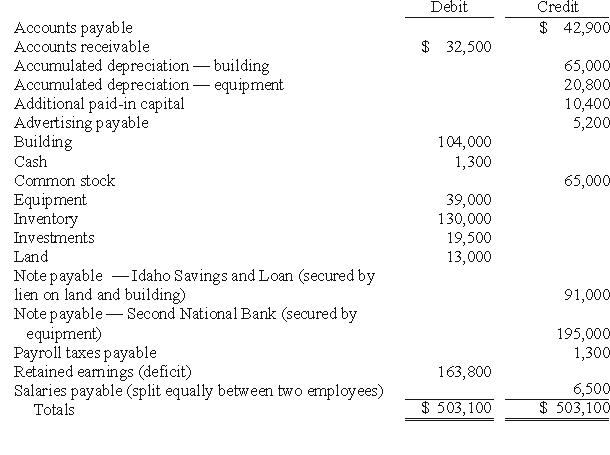

Mount Inc.was a hardware store that operated in Boise,Idaho.Management made some poor inventory acquisitions that loaded the store with unsalable merchandise.Due to the decline in revenues,the company became insolvent.Following is a trial balance as of March 15,2009,the day the company filed for a Chapter 7 liquidation.  Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated.The building and land had a fair value of $97,500,while the equipment was worth $24,700.The investments represented shares of a nationally traded company that could be sold at the time for $27,300.The entire inventory could be sold for only $42,900.Administrative expenses necessary to carry out a liquidation would have approximated $20,800.

Company officials believed that sixty percent of the accounts receivable could be collected if the company was liquidated.The building and land had a fair value of $97,500,while the equipment was worth $24,700.The investments represented shares of a nationally traded company that could be sold at the time for $27,300.The entire inventory could be sold for only $42,900.Administrative expenses necessary to carry out a liquidation would have approximated $20,800.

-Required:

Prepare a statement of financial affairs for Mount Inc.as of March 15,2009.

Definitions:

Non-current Liability

Liabilities that are not due within the next twelve months, such as long-term loans, bonds payable, and deferred tax liabilities.

Short-term Loans

Loans scheduled to be repaid in less than a year, typically used for immediate cash flow needs or small-scale expenses.

Cash Flows

Cash flows refer to the inflows and outflows of cash and cash equivalents, representing the operating, investing, and financing activities of an entity during a specific period.

Operating Activities

Activities directly related to the business’s primary operations, such as sales, costs, and expenses, impacting the company's cash flow.

Q30: Sarah gave her granddaughter, Alice, some Eli

Q36: The American Opportunity Scholarship Tax Credit provides

Q36: Which group of financial statements is prepared

Q44: What is Cleary's capital account balance at

Q51: Required:<br>Assume that Boerkian was a foreign subsidiary

Q58: How are assets and liabilities valued on

Q75: Total liabilities with priority are calculated to

Q86: What is the balance in Acker's Investment

Q90: What is the balance in the investment

Q102: Primary valuation date<br>A)Begins on the day after