REFERENCE: Ref.13_08

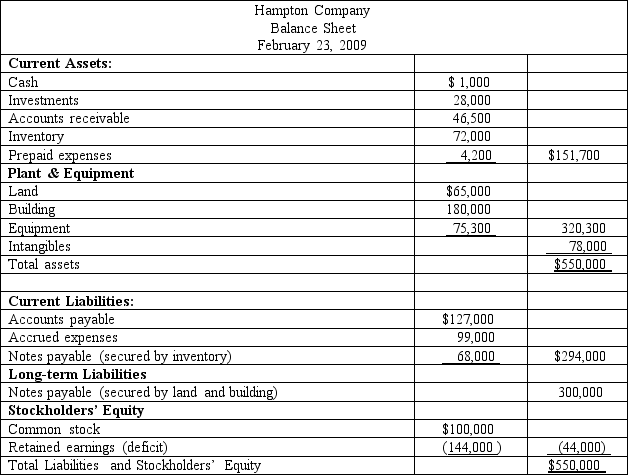

Hampton Company is trying to decide whether to seek liquidation or reorganization.Hampton has provided the following balance sheet:

Additional information is as follows:

Additional information is as follows:

- The investments are currently worth $13,000.

- It is estimated that $32,000 of the accounts receivable are collectible.

- The inventory can be sold for $74,000.

- The prepaid expenses and the intangible assets have no net realizable value.

- The land and building are currently valued at $250,000.

- The equipment can be sold for $60,000.

- Administrative expenses (not yet recorded)are estimated to be $12,500.

- Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

- Accrued expenses include $7,000 of unpaid payroll taxes.

-Compute the amount of free assets after payment of liabilities with priority.

Definitions:

Title Style

Formatting applied to titles in documents, presentations, or web pages to distinguish them from other text.

Data Series

In charting or graphical representations, a set of related data points or values that are plotted or represented.

Texture

The feel, appearance, or consistency of a surface or a substance.

WordArt

A feature in Microsoft Office applications that allows users to create stylized text with various effects like texture, shadows, and shapes.

Q16: Total unsecured liabilities are calculated to be

Q22: Which group of governmental financial statements reports

Q25: How much will be paid to the

Q26: Which one of the following forms is

Q27: Sanford gives Mitchell 100 shares of stock

Q43: For the purpose of government-wide financial statements,the

Q51: When is the SEC's Registration Form S-4

Q66: Under what circumstances would the translation of

Q90: What is the balance in the investment

Q93: During January 2007,Wells,Inc.acquired 30% of the outstanding