REFERENCE: Ref.10_05

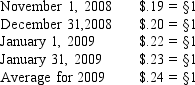

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-What figure would have been reported for this inventory on Porter's consolidated balance sheet at December 31,2008?

Definitions:

Decision Rules

Guidelines or criteria used to make choices among alternatives in decision-making processes.

Cost of Capital

Cost of capital refers to the minimum rate of return that a company must earn on its investments to maintain its market value and satisfy its stakeholders.

Future Cash Flows

Estimates of the amount of money to be received or paid out in the future by an entity.

Negative NPVs

Instances where the Net Present Value (NPV) of a project or investment is below zero, indicating that the expected cash flows are not sufficient to cover the initial investment.

Q10: The prospectus part of a registration contains

Q30: On a statement of financial affairs,a specific

Q42: Compute the cost of goods sold for

Q43: A net liability balance sheet exposure exists

Q58: Aqua Corp.purchased 30% of the common stock

Q58: Eden acquired a 20% interest in the

Q61: What is the Equity in Howell Income

Q65: On June 10, 2017, Wilhelm receives a

Q76: Which of the following type of organization

Q80: Assume the functional currency is the euro,compute