REFERENCE: Ref.10_05

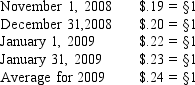

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-Under the temporal method,common stock would be restated at what rate?

Definitions:

Direct Labor-Hours

Total time spent by staff members who are directly part of the manufacturing operations.

Fixed Manufacturing Overhead

Fixed manufacturing overhead includes regular, consistent costs involved in manufacturing that do not vary with the level of production, such as salaries of managers and factory rent.

Job-Order Costing System

A cost accounting system that assigns manufacturing costs to a specific product or batches of products, often used in customized production environments.

Predetermined Overhead Rate

A rate calculated before a period begins, used to allocate estimated overhead costs to products or job orders based on a selected activity base, such as direct labor hours.

Q2: Cory is a 32 years old, unmarried,

Q5: The employees of the City of Raymond

Q10: What is the role of the trustee

Q11: The town of Wakefield opened a solid

Q17: Hobby expenses of $2,500. Hobby income is

Q24: Perry inherits stock from his Aunt Margaret

Q26: What international organization currently promulgates IFRSs?<br>A)IASB.<br>B)IASC.<br>C)IOSCO.<br>D)FASB.<br>E)EU.

Q44: How should a permanent loss in value

Q56: Farley Brothers,a U.S.company,had a subsidiary in Italy.Under

Q72: When translating Quadros' financial statements,which of the