REFERENCE: Ref.10_05

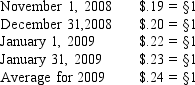

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-Under the temporal method,retained earnings would be restated at what rate?

Definitions:

Salary Expense

The cost incurred by a company for the payment of regular salaries to its employees.

Accrued Salaries

Salaries that have been incurred but not yet paid by the end of a financial period, representing a liability for the business.

Closing

The process of finalizing accounting records at the end of an accounting period, including updating accounts and preparing financial statements.

Adjustments

Entries made in accounting records to correct errors or allocate revenues and expenses to the appropriate accounting period.

Q2: A local partnership was considering the possibility

Q13: Under the legislative grace concept, Congress allows

Q49: Develop a predistribution plan for this partnership,assuming

Q51: What was the total amount of unsecured

Q54: On January 1,2008,Fandu Corp.started a foreign subsidiary.On

Q66: A local partnership was in the process

Q79: All of the following statements regarding the

Q91: Sergio wants to know if he can

Q110: Alli is 23 years old, a full

Q113: When should an investor not use the